For decades, Governance, Risk, and Compliance (GRC) was viewed as the exclusive domain of large enterprises—organizations with sprawling departments, limitless budgets, and armies of internal auditors. Small and Medium-Sized Businesses (SMBs) often operated under the assumption that they were “too small to target” or “too agile to need bureaucracy.”

That assumption is no longer valid. In the current business landscape, SMBs face the same sophisticated cyber threats, regulatory pressures (GDPR, CCPA, SOC 2), and operational risks as their enterprise counterparts, but often without the equivalent resources to manage them.

This document outlines a modern, scalable approach to GRC for SMBs. It argues that GRC is not a cost center, but a value driver. By implementing “Right-Sized GRC,” SMBs can accelerate sales cycles (through trust), reduce the cost of insurance, prevent catastrophic loss, and prepare for scalable growth. This guide covers the three pillars of GRC, common pitfalls, a step-by-step implementation roadmap, and the role of automation in making GRC manageable for lean teams.

1. Introduction: The Shifting Landscape for SMBs

1.1 The Definition of GRC in an SMB Context

While the acronym is standard, the application of GRC varies significantly by company size.

- Governance: For an SMB, this is not about rigid committees; it is about decision-making clarity. It ensures that the company’s objectives are set, and the “tone at the top” aligns with ethical boundaries and business goals.

- Risk Management: This is the ability to anticipate surprises. It involves identifying threats (cyber, financial, operational) and deciding whether to accept, mitigate, or transfer them.

- Compliance: This encompasses the “license to operate”—adhering to laws, regulations, and increasingly, the contractual demands of larger customers.

1.2 Why Now? The “Risk Reckoning”

Recent data indicates a critical shift in the risk environment for the mid-market:

- The Supply Chain Pressure: Enterprise clients are pushing risk down the supply chain. SMBs are increasingly required to prove SOC 2 or ISO 27001 compliance just to bid on contracts.

- The Cyber Target: SMBs are the “low hanging fruit” for ransomware. Without a dedicated security operations center (SOC), they are vulnerable to automated attacks.

- The Regulatory Drag: Privacy laws like GDPR and local equivalents do not exempt businesses based on size. A single violation can cost a significant percentage of annual revenue.

- The Cost of Non-Compliance: Research suggests that while the absolute cost of compliance is lower for SMBs, the relative impact of non-compliance (fines, reputation loss) is nearly 280% higher for SMBs than enterprises when adjusted for revenue.

2. Governance: Building the Foundation Without Bureaucracy

Governance is often the most misunderstood pillar in smaller organizations, feared as a source of “red tape.” However, agile governance is the backbone of speed and autonomy.

2.1 The “Agile Governance” Model

For an SMB, governance should be lightweight but ironclad. It focuses on three core elements:

- Role Clarity: In a 50-person company, the CTO might also be the CISO. Governance requires documenting this dual role to ensure no conflict of interest prevents risk reporting.

- Policy Management: Instead of a 500-page manual nobody reads, Agile Governance focuses on critical, enforceable policies (e.g., Acceptable Use, Data Classification, Remote Work Security).

- Decision Velocity: Establishing clear thresholds for decision-making. Who can approve a vendor? Who signs off on a risk acceptance?

2.2 Board and Leadership Oversight

Even in private, founder-led companies, a “Board of Advisors” or a formal Steering Committee helps reduce “Founder Risk.”

- Objective: To move from “gut-feeling” management to “evidence-based” management.

- Action: Quarterly GRC reviews should be mandatory. These are not just financial reviews but specific sessions on Risk Posture and Compliance Health.

2.3 Policy Management for Lean Teams

The Challenge: SMBs often rely on “tribal knowledge”—processes are known but not written down. If a key employee leaves, the governance structure collapses. The Solution:

- Centralize: Use a single repository (e.g., SharePoint, Confluence, or a GRC tool) for all policies.

- Simplify: A policy should be 2-3 pages max. If it’s longer, it’s a procedure, not a policy.

- Automate Acknowledgment: Use tools to track who has read and signed off on policies annually.

3. Risk Management: The Defensive Shield

For SMBs, Risk Management is often reactive (fighting fires) rather than proactive (fire prevention). Moving to a proactive stance is the highest ROI activity a business can undertake.

3.1 The SMB Risk Landscape

Risks for SMBs generally fall into four buckets: | Risk Category | Examples | Mitigation Strategy | | :— | :— | :— | | Strategic | Market shifts, competitor disruption, failed product launch. | Market analysis, diversification, agile planning. | | Operational | Key person failure, supply chain disruption, IT outage. | Cross-training, redundant vendors, Disaster Recovery (DR) plans. | | Financial | Cash flow gaps, fraud, interest rate changes. | Cash reserves, internal financial controls, insurance. | | Cyber/InfoSec | Ransomware, phishing, data breach, insider threat. | MFA, EDR, Security Awareness Training, Incident Response Plan. |

3.2 Conducting a “Right-Sized” Risk Assessment

Enterprises spend months on risk assessments. SMBs should spend days.

- Asset Inventory: You cannot protect what you don’t know you have. List all hardware, software, and data.

- Threat Modeling: Ask “What keeps us up at night?” (e.g., What if AWS goes down? What if our lead dev quits?).

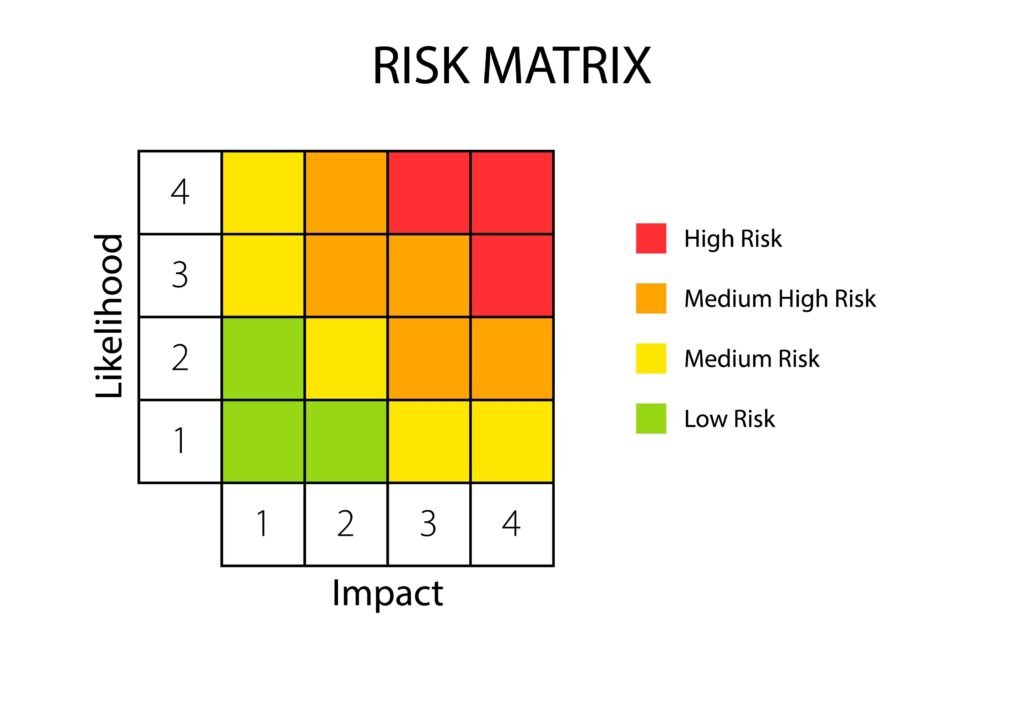

- Impact Analysis: Score risks on a simplified 1-5 scale for Likelihood and Impact.

- Risk Register: Create a “Living Risk Register.” This is not a static PDF but a dynamic list reviewed monthly.

3.3 Third-Party Risk Management (TPRM)

SMBs rely heavily on SaaS tools and vendors.

- The Trap: Assuming that because you use Salesforce or Google Workspace, you are secure.

- The Reality: The “Shared Responsibility Model” means you are responsible for how you configure those tools and who accesses them.

- Action: Vendor assessments should be mandatory before purchase. Ask for their SOC 2 report. If they are small, ask for their security questionnaire.

4. Compliance: The License to Operate

Compliance is often seen as a burden, but for SMBs, it is a powerful sales enabler. Being “SOC 2 Type II” compliant is a badge of trust that allows a $5M company to close deals with $5B enterprises.

4.1 Key Frameworks for SMBs

- SOC 2 (Service Organization Control): The gold standard for SaaS and tech service providers. It focuses on Security, Availability, Processing Integrity, Confidentiality, and Privacy.

- ISO 27001: The international standard for Information Security Management Systems (ISMS). More rigorous and documentation-heavy than SOC 2, but recognized globally.

- GDPR / CCPA: Essential for any SMB handling consumer data in Europe or California.

- HIPAA: Non-negotiable for healthcare-adjacent SMBs.

4.2 The “Checklist” Mentality vs. Continuous Compliance

Many SMBs treat compliance as an annual “cram session” before an audit. This is dangerous and expensive.

- Continuous Compliance: Implementing controls that run 24/7 (e.g., automated evidence collection that proves backups happened every day, not just the day the auditor checked).

- Audit Fatigue: Using a “Test Once, Comply Many” approach. Mapping a single control (e.g., “MFA on email”) to satisfy SOC 2, ISO 27001, and HIPAA simultaneously.

5. Implementing GRC: A Phased Approach

How does a lean organization eat the GRC elephant? One bite at a time.

Phase 1: Discovery & Strategy (Weeks 1-4)

- Identify Stakeholders: Form a “GRC Working Group” (CEO, CTO, Head of Ops).

- Gap Analysis: Compare current practices against a standard framework (e.g., CIS Critical Security Controls or NIST CSF).

- Define Risk Appetite: Determine how much risk the organization is willing to accept to achieve speed.

Phase 2: Foundation & Remediation (Months 2-6)

- Policy Creation: Draft the “Core 10” policies.

- Control Implementation: Deploy MFA, Encrypt laptops, set up background checks.

- Vendor Cleanup: Review and terminate unused or risky vendor contracts.

Phase 3: Operationalization (Months 6-12)

- Tool Selection: Move off spreadsheets. Select a GRC platform appropriate for SMBs (e.g., Drata, Vanta, Secureframe, or a right-sized GRC suite).

- Training: Roll out security awareness training to all staff.

- Audit Readiness: If pursuing SOC 2/ISO, engage a pre-assessment auditor.

Phase 4: Continuous Improvement (Year 1+)

- Quarterly Risk Reviews: Update the risk register.

- Incident Response Drills: Tabletop exercises (e.g., “Simulate a ransomware attack”).

- Metrics & KPIs: Track “Time to Remediate” vulnerabilities and “Policy Acknowledgement Rates.”

6. Challenges and Common Pitfalls

6.1 The “Spreadsheet Trap”

60-80% of SMBs start GRC on Excel. While flexible, spreadsheets lack version control, audit trails, and automated reminders. They eventually become “Zombie Documents”—dead files that no one updates until a crisis hits.

6.2 “Checking the Box”

Implementing a tool or policy just to pass an audit, without actually changing behavior.

- Example: Creating a “Clean Desk Policy” but leaving passwords on sticky notes.

- Consequence: This creates a false sense of security and liability during a breach.

6.3 Resource Constraints

“We don’t have the budget for a Compliance Officer.”

- Solution: Fractional CISO/GRC. Hiring a virtual CISO (vCISO) for 5 hours a month is more effective than assigning GRC to an overworked IT Manager who lacks the expertise.

7. The Role of Technology and Automation

The era of manual GRC is ending. Automation is the only way SMBs can compete with enterprises on compliance.

7.1 Automated GRC Platforms

Modern platforms connect directly to your tech stack (AWS, GitHub, Google Workspace, HRIS) to automatically pull evidence.

- Benefit: Reduces manual evidence collection by up to 80%.

- Continuous Monitoring: Alerts you immediately if a server is unencrypted or an employee is offboarded without access revocation.

7.2 AI in GRC

- Policy Mapping: AI can scan your policies and map them to new regulations instantly.

- Vendor Risk: AI tools can scan the public web for negative news or breaches regarding your vendors.

- Questionnaire Fatigue: AI agents can auto-fill the hundreds of security questionnaires SMBs receive from enterprise prospects.

8. The Business Case: ROI of GRC

To secure budget, GRC must be framed as an investment.

- Sales Acceleration: A SOC 2 report can reduce the “Security Review” phase of a sales cycle from 4 weeks to 4 days.

- Lower Insurance Premiums: Cyber insurance is becoming expensive and hard to get. Demonstrating a mature GRC program (MFA, Incident Response Plans) can reduce premiums by 20-40%.

- Valuation Multiples: For SMBs looking to exit/sell, a clean “Data Room” with documented compliance and low risk increases the company’s valuation and speeds up Due Diligence.

- Operational Resilience: The cost of downtime is approximately $5,600 per minute (Gartner). GRC prevents downtime.

9. Conclusion

For Small and Medium-Sized Businesses, GRC is no longer optional. It is the infrastructure of trust. As the digital economy becomes more interconnected, the businesses that survive and scale will be those that view Governance, Risk, and Compliance not as a burden, but as a strategic capability.

By starting small, leveraging automation, and focusing on a risk-based approach, SMBs can build a GRC program that is resilient, compliant, and ready for growth.

Action Plan for Leadership

- [ ] Week 1: Designate a GRC Lead (internal or fractional).

- [ ] Week 2: Conduct a high-level Risk Assessment (Top 5 Risks).

- [ ] Month 1: Implement MFA everywhere and draft an Incident Response Plan.

- [ ] Month 3: Select a GRC Platform and begin the journey toward SOC 2 or relevant framework.